Banks And Their Role as Shadow Central Bankers (Continued)

March 10, 2022

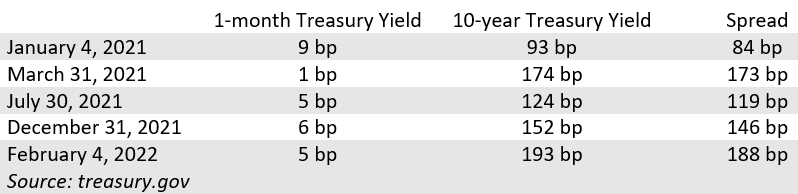

Since the beginning of 2021, the spread available to banks for holding Treasuries has gradually widened, as shown in the table below.

Some might believe that the current inflationary pressure was caused by the necessary Federal Reserve policy to deal with the spread of COVID-19.

On March 31, 2020, near the inception of the crisis and arguably the time of greatest uncertainty, according to treasury.gov, the one-month Treasury bill yielded 5 bp, while the 10-year Treasury yielded 70 bp, for a spread of 65 basis points. The February 4, 2022 spread, at 188 basis points, is almost three times greater than it was at the inception of the disruptions relating to the coronavirus.

Banks have a far greater incentive to purchase Treasury securities now than at the inception of the spread of COVID-19. Therefore, there is no need for the Federal Reserve to continue to purchase U.S. Treasuries—the banks have more than sufficient assets to continue accumulating Treasuries, funding the U.S. federal deficit, which is currently estimated to exceed $2.8 trillion annually (cbo.gov).

This post was also published on Twitter/X. Click to see this post:

Confidentiality Notice: This post, and any attachments, contains information that is, or may be confidential or proprietary in nature. If you are not the intended recipient, please be advised that you are legally prohibited from retaining, using, copying, distributing, or otherwise disclosing this information in any manner. Furthermore, this communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell securities or any product.

© 2023 Horizon Kinetics LLC ®. All rights reserved.